6 Easy Tips for Anyone Who Rents Cars Frequently

Over the last 15 years, I've rented a lot of cars. I went about 15 years without owning a car until a few years ago, but as I recently sold my ride, I'm back on the car-less road again. Whether to run errands, for convenience or while traveling, I've rented cars many times and have seen my fair share of it all. To that end, I wanted to share some quick tips that are useful to anyone renting a vehicle. These are numbered for tidiness but not listed in any particular order of importance. Let's jump into it.

Six Car Rental Tips for a Smooth Rental Experience

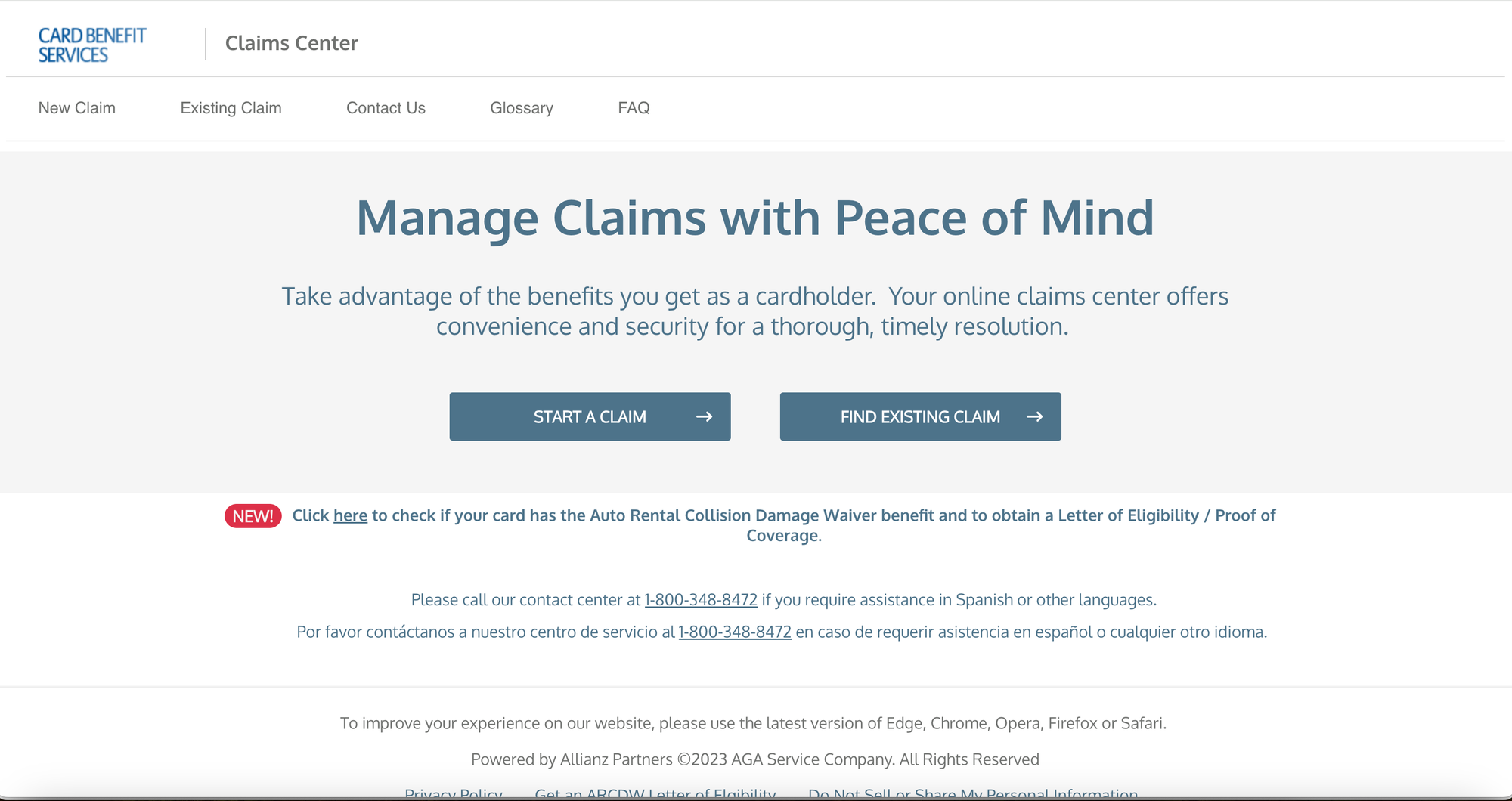

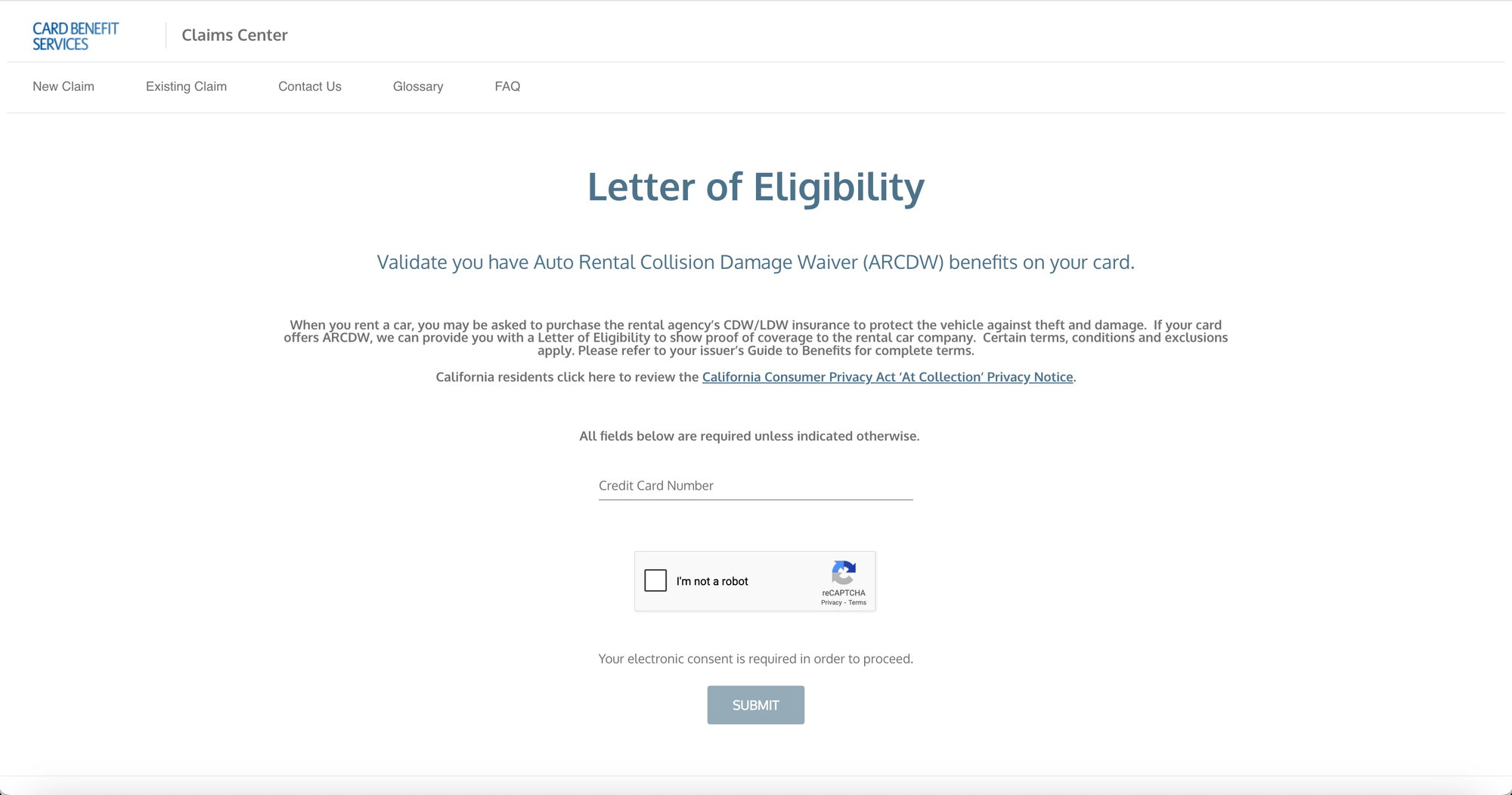

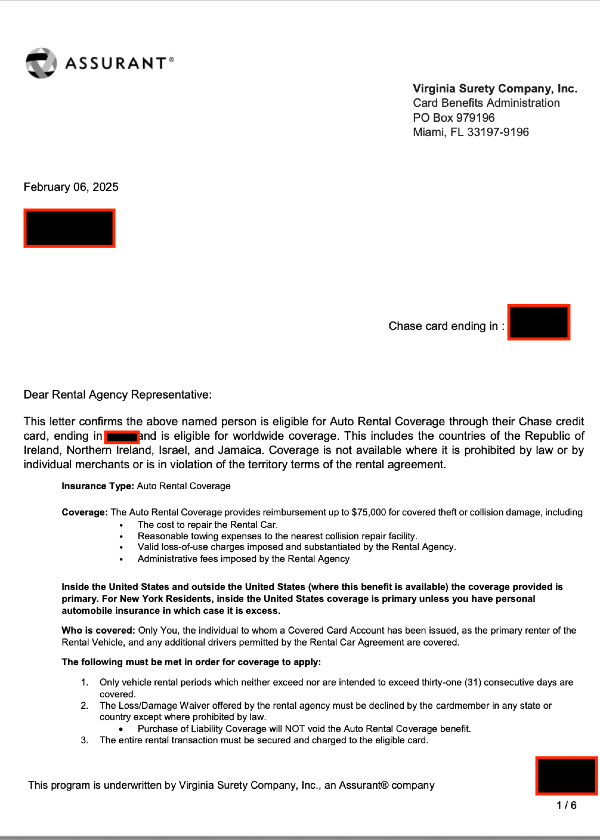

- Procure a letter of proof of coverage from your credit card company and keep it handy.

This one is simple and particularly clutch if you plan on renting cars internationally. Some rental car companies will request proof of coverage through your credit card. 'Proof' usually comes in the form of a letter from your credit card company stating 1) that you are a cardholder, 2) that you are eligible for coverage, and 3) your coverage limits and terms.

Some credit card companies, like Chase, make it easy to procure a letter online. You can visit eclaimsline.com and follow the prompts to get retrieve a letter online.

If you're more of an 'over the phone' person, you can call the number on the back of your credit card, ask to be transferred to the card benefits department, and submit your request. They can usually shoot over a letter within a few minutes. As I recently procured a letter for each of my Chase cards that offer primary coverage, I have the department's number handy. Have at it: 1-888-320-9961.

Getting proof of coverage - Source: You Are Travel

- Shop local, independent, 'mom and pop' car rental companies for better service and greater flexibility.

Like many other industries, car rentals tend to be dominated by franchised chains. With greater distribution, they are often the results that might pop up first in search engines, bank portals, online travel agencies (OTAs) like Kayak, or even bargained-for platforms like Costco Travel. I've found some gems in smaller, independent car rental companies that often provide higher-quality, more personalized service at the same price point. On a trip to Vancouver a few years back, I rented a vehicle through Expo Rent a Car, and the service was solid, personable, efficient, and flexible. Though I ultimately ended up picking up and returning the rental at downtown facility, I was offered the option of a having the car dropped off to my hotel and airport drop-off (at no additional fee) to make things easier on my way out of town. The rates were also lower than those of the leading chains in the surrounding area, car availability and vehicle options were stronger, and the cost of add-ons (satellite radio, GPS) were cheaper as well.

- Search for longer-term rates (even if you plan on returning the car sooner) to save some cash.

Rental car rates can at times, be bonkers. If you plan on renting a car for four days, consider comparing a weekly rate, as it could be cheaper. In most cases, you usually won't be penalized for returning the vehicle early (particularly in cities where inventory is low/turns over quickly as companies are eager to get a car back to rent it out to someone else). Still, it's a good idea to check the terms of your rental agreement to confirm.

- Be meticulous about documenting your vehicle's condition before you pull off.

This one is obvious, but you'd be surprised by how often folks fail to do this. In fact, just THIS MORNING, I picked up a rental car and while in the office, I witnessed another renter (who was also picking up a vehicle) going back and forth with the rental car agent to ensure they documented the scratch she found on her vehicle while doing a walkaround. After some placating that the scratch was inconsequential (since as according to him 'it was not bigger than a 500-cent coin') she relented.

Do you know what she didn't do in all this time? Take a photo or video for her records. I watched her drive off without this, still susceptible to a 'my word vs. your word' dispute upon return.

It only takes a few seconds to hit a record on your phone and walk around your vehicle, then hit 'stop' and walk back around, snapping a few photos. I've personally experienced the value of this. About a year ago, I received a message from Enterprise claiming that I was liable for damage to a recently returned rental car. For starters, I knew this was bogus from the jump as the dates of rental and damage were long after I had returned the vehicle. But a quick response containing the two video walkthroughs I did of the car, the one at pickup and the one at drop-off, immediately put the issue to bed.

Take both video and photos of your rental vehicle - Source: You Are Travel

- Use a dedicated credit card with the right mix of coverage and a modest credit limit to minimize your risk against unsavory business practices.

You may know that a credit card with primary rental car insurance can save you a lot of money when waiving the collision damage coverage on your rental. Several Chase cards offer primary coverage, as does Capital One's Venture X and any American Express card enrolled in the American Express Premium Car Rental Protection program.

But how do you protect against situations where a rental car company may try to pull a fast one? It's common for rental car companies to take a hefty deposit for the car rental and then return that money to your card when you bring the car back in proper condition (no damage, mileage within limits, gas refilled as necessary, etc.). While this isn't something I've personally experienced, I have heard (and read) about many instances in which a rental car company has assessed bogus charges aimed at keeping the deposit (or insisting upon additional payment) and even situations in which a card number has been recorded and used for other purchases (stolen).

Using a dedicated credit card that has just enough of a credit limit to get you by can help avoid any unsavory situations where you end up with hefty, outlandish charges to your card. Of course, you can dispute bogus charges with your bank, but it's much less worrisome if the maximum amount any company can charge to your card is capped. Additionally, having a dedicated card that you use only for car rentals and not other spending can make it easy to close a card and move on from it without having to worry about impacting your everyday spending strategy or loyalty spending that may be attached to a co-branded credit card (i.e. United Explorer Card).

The sweet spot could be a low annual or no annual fee card, providing full coverage with a monthly limit high enough to cover any reasonable rental car rates (based upon how you travel) and $1000 (or less) on top of that for a deposit. Some worthy contenders are the Ink Business Cash Credit Card ($0 annual fee), Ink Business Unlimited Credit Card ($0 annual fee), Chase Sapphire Preferred Card ($95 annual fee), Ink Business Preferred Credit Card ($95 annual fee).

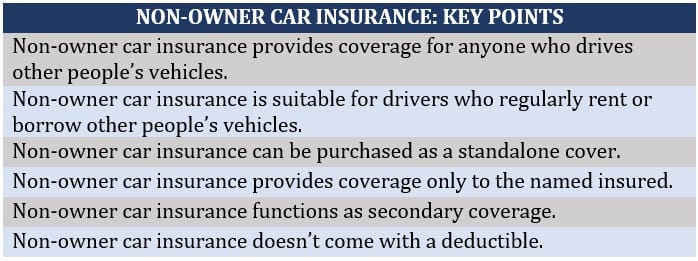

- Consider purchasing a non-owner's car insurance policy.

This one is my personal favorite. If you rent cars frequently, consider purchasing coverage as a non-owner's policy. This lesser-known insurance policy covers you when you're a driver in any vehicle that is not your own (say, a friend's vehicle or, of course, a rental car). The benefit is that for a relatively low price, you'll have full coverage beyond what is afforded with your credit card - even if your credit card covers primary coverage. A non-owner's policy, in addition to liability coverage, may also include medical payments and/or personal injury protection coverage and uninsured or underinsured motorist insurance coverage. In contrast, primary rental car coverage through your credit card will typically cover collision damage (damage to the rental car), towing, and administrative fees but usually excludes liability for damages to other people, property, or vehicles; personal belongings - it doesn't cover loss or theft of personal belongings inside the car; or medical bills.

The math adds up here as well. Typically, liability insurance (in situations when it's optional) can cost anywhere from $14.99 to $30 per day. Let's say you're paying the high end of that range for a two-week rental - that's $420! For the same amount or less, you can have a non-owners policy that provides premium coverage for the entire year.

Source(s): Ultracar Insurance & insurancebusinessmag.com

Conclusion

Whether you're a frequent traveler, someone between vehicles, or planning on renting a car for the first time, it helps to know some tips that can make your rental car experience go smoothly. I'd love to hear some of your own tips in the comments!