Introduction to Points and Miles - a Primer

Check out this beginner's guide to kickstart your points and miles journey!

You've heard snippets from friends, family, coworkers, and that one person at the gym who can never sit with the silence - it seems everyone you know is snapping up fantastic deals by earning and redeeming travel rewards. You want to get involved, and you wish someone would give you a quick once-over to bring you up to speed. Well, let's go to tape:

At its simplest, the "points and miles game" distills to:

- Earning rewards points

- Redeeming those points you've accumulated for free, discounted, or subsidized travel

And…what are points and miles? They are simply the currency for a travel provider's or financial institution's loyalty program. Travel providers include hotels, airlines, cruise operators, rental car companies, etc. You can redeem points to cover the cost of travel offered by various travel providers (or, as we'll discuss later, partners of the travel provider). 'Points' is often used as a catch-all term. However, travel providers use specific branded nomenclature to denote their currencies (i.e., World of Hyatt Points, Marriott Bonvoy Points, Enterprise Plus Points, etc.). Banks also brand their reward points. You may have heard of American Express Membership Rewards Points, Chase Ultimate Reward Points, Citi ThankYou Points, etc.

Airlines are the travel providers who most often use the term 'miles', as back in the day, that's how they were mapped—you earned reward miles based upon the mileage flown (originally on a 1:1 basis where every mile flown was 1 mileage point banked into a frequent flier account). Hence, the terms mileage programs, mileage clubs, etc. So far, so good?

Before diving deeper, it's worth discussing why people care about this. Because redeeming points and miles can help you significantly stretch your dollars by making travel more affordable and frequent. For fans of luxury travel, points and miles help make premium travel experiences attainable at a much lower cost. Whether you take ten trips a year or are just looking for a way to save some money on an upcoming weekend hotel stay - if you travel at all - there's real value in points, and it's helpful to understand how it all works. There's something in it for everybody.

Earning Points and Miles

There are many ways to earn points, but we'll focus on three of the most common:

- Traveling with Travel Providers

- Credit Cards - Welcome Bonuses, Spending, and Referrals

- Buying Points / Gifting Points

These are by no means the only ways to earn points and miles. We aren't diving into the glamorous world of shopping portals, third-party travel agencies, or the many ways folks pad their points and miles stashes. Again, as this is a brief introduction, we'll just cover the three above.

Traveling with Travel Providers

You earn points when you book and complete travel with travel providers. To earn points with a travel provider, you'll almost always need to pay cash (as opposed to redeeming rewards points).

The very first step to earning points or miles with any travel provider is to register for their loyalty program. Here’s a simple Google Sheet I created to help you keep track of login info for the various airlines/hotel loyalty programs. Feel free to ‘make a copy’ and make it your own. You’ll want to make sure you include your loyalty number whenever you book travel with a travel provider or one of its partners.

Ok back to it! Book a ticket and fly with American Airlines and earn some AA miles. Rent a car with Avis and reap some Avis Preferred Points. Pay for a night at the Intercontinental and you'll accumulate IHG reward points towards your next stay. One week at sea with Carnival, means one point for each day you're cruisin'. Fair enough.

The number of points you earn will differ depending on each travel provider's loyalty program. Nowadays, many travel providers opt for a revenue-based program, awarding consumers points based upon the amount of money they spend (i.e., 6X per dollar). Most commonly, airlines—though a diminishing number—adhere to distance-based programs, where points are earned based on the distance you travel.

The original concept of loyalty programs was to incentivize travelers to patron travel providers by providing sweeteners in the form of reward points redeemable for future travel. As the popularity of these reward points grew, travel providers sought out new ways to capitalize on their growing loyalty base while extending their brands to new domains. They found partners in banks and financial institutions. Banks, in turn, sought ways to offer diversified products to existing customers, court new cohorts, and establish new revenue channels utilizing their underlying financial infrastructure. The chief tool of these partnerships? Credit Cards.

Credit Cards

When it comes to points and miles, there's always a ton of chunder around credit cards, and rightfully so - spending (responsibly) with credit cards is a great way to earn tons of points and miles. Before diving into how credit card spending helps you earn points and miles, let's discuss some types of credit cards you'll likely come across.

Bank Cards

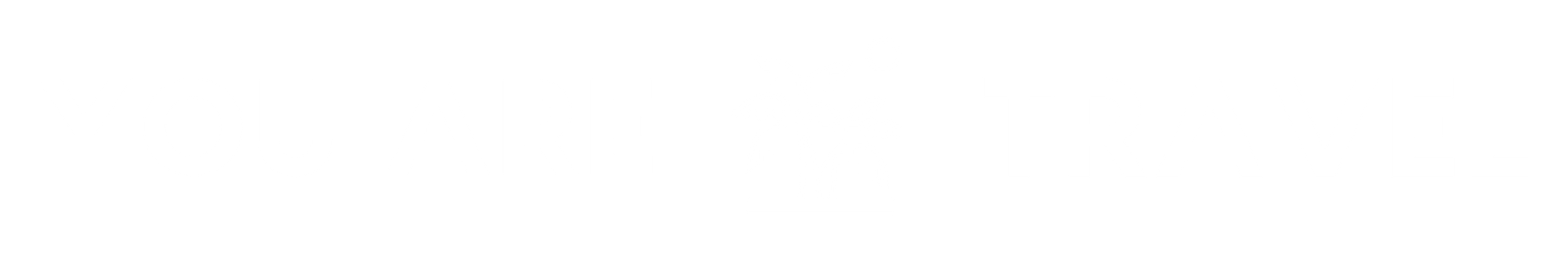

Regarding points and miles, 'bank cards' generally refer to cards issued by a handful of larger banks that allow consumers to earn versatile rewards points and redeem them 1) directly through the bank's travel portal or 2) transfer them to travel providers for redemption. Thus, the reward points you earn when spending on these bank cards are often known as 'bank points or transferable points.' These are four prominent financial institutions to know about:

- American Express credit cards earn Membership Rewards

- JP Morgan Chase credit cards earn Ultimate Rewards

- Capital One credit cards earn Capital One Venture Rewards

- Citi Credit Cards earn Citi ThankYou Points

Other, less versatile (in that they have limited or no transfer partners) financial institutions allowing you to earn bank points are:

- Wells Fargo Autograph cards end Wells Fargo Rewards

- Bank of America Travel Rewards credit cards earn Travel Rewards

- U.S. Bank Altitude credit cards earn U.S. Bank bonus points

Lastly, Bilt is a company founded in 2021 that first entered the rewards space by offering consumers the ability to earn rewards points by paying rent. Bilt partners with Wells Fargo to issue its own cards. That said, as a venture-backed startup, Bilt is said to be hemorrhaging money and has seen a few different transfer partners (travel providers) offboard from its platform recently. Coupled with decreased earning opportunities for its customers, it's unclear how long Bilt will remain a viable option for consumers.

Annual Fees and Additional Benefits

Credit cards may have annual fees - a recurring yearly cost to hold the credit card. Banks typically offer a tiered lineup of cards - starter credit cards, mid-level, and premium credit cards, with the associated annual fee increasing accordingly. A starter-level card may have no annual fee (or a lower annual fee waived for the first year of card membership), and the yearly fee of a premium card might cost you a few hundred dollars.This is a topic for another day, but it's important to note that credit cards have benefits other than welcome bonuses and the ability to earn reward points. Most often, you'll find that the more premium cards with the higher annual fees also offer the most comprehensive array of additional benefits.

Co-branded Cards

Co-branded cards are credit cards issued by a bank or financial institution in partnership with a specific travel provider. These cards allow you to earn points or miles particular to the named travel provider's loyalty program. There are many co-branded cards in the marketplace, and almost every notable travel provider offers at least one. For example, JP Morgan Chase partners with Hyatt Hotels to issue the World of Hyatt® Credit Card. Barclays teams up with Hawaiian Airlines for the Hawaiian Airlines® World Elite Mastercard. Bank of America and Royal Caribbean offer the Royal Caribbean Visa Signature® Card. Spending these credit cards will earn you Hyatt points towards free hotel stays, Hawaiian Miles towards free flights, and Royal Caribbean points towards free cruises, respectively. As co-branded cards often tie into the travel provider's loyalty program, credit card customers who also hold elite 'status' (discussed in greater detail later) with the travel provider are sometimes eligible to earn rewards at a higher rate when spending on their card. Like bank cards, co-branded cards have tiered lineups and may have annual fees.

Personal Cards vs. Business Cards

Many card issuers offer both personal credit cards and business credit cards. Both personal cards and business cards are eligible for rewards. Personal cards are straightforward - you apply for and take out a credit card in your name. There's a misconception that to be eligible for business cards, you must own and run some well-oiled money-printing operations. That is far from true. Any (legal) side hustle, or really, any semi-regular activity where you earn even a little bit of money is likely enough to incorporate around and can likely incorporate and qualify for a business credit card. Flipping items from thrift stores or marketplaces, selling on eBay, doing hair, mowing lawns, babysitting, caring for pets, tutoring - all jobs/hustles you can set up a business around. Aside from the potential tax benefits (deeper discussion with your tax preparer), doing so can make it much easier to gain approval for business credit cards that offer lucrative welcome bonuses (discussed below) while often providing premium card benefits in functional categories like insurance and supplies. Nowadays, getting a business setup is very easy with tools like Stripe Atlas.

Welcome Bonuses

Introductory welcome bonuses (welcome offers) are great for quickly stockpiling reward points. Card issuers offer chunks of reward points to new customers who successfully apply for their card and spend a predetermined amount of money on their credit cards within a given time frame. These offers will look something like this: "Earn 75000 reward points for spending $4000 in your first 90 days." You'll find welcome offers on bank cards, co-branded cards, and both personal and business cards.

Credit Card Spending

You earn rewards points when you spend money with your credit cards. Bank cards earn rewards points in the currency of the issuing bank (i.e., Citi ThankYou Points), and co-branded cards earn points or miles towards the travel provider (spending on The Delta SkyMiles® Gold American Express Card will earn you Delta SkyMiles). Notably, credit card spending is often bonused and incentivized towards expenditures for specific categories or items. For example, using the Ritz-Carlton Card will earn six points for every dollar you spend at Marriott hotels. You earn four AMEX Membership Rewards for every dollar you spend at supermarkets. CapitalOne famously awards two points for every dollar spent on any purchase when using its flagship CapitalOne Venture Card. Taking advantage of bonuses by spending on credit cards is a great way to maximize the number of points and miles you can earn from everyday purchases.

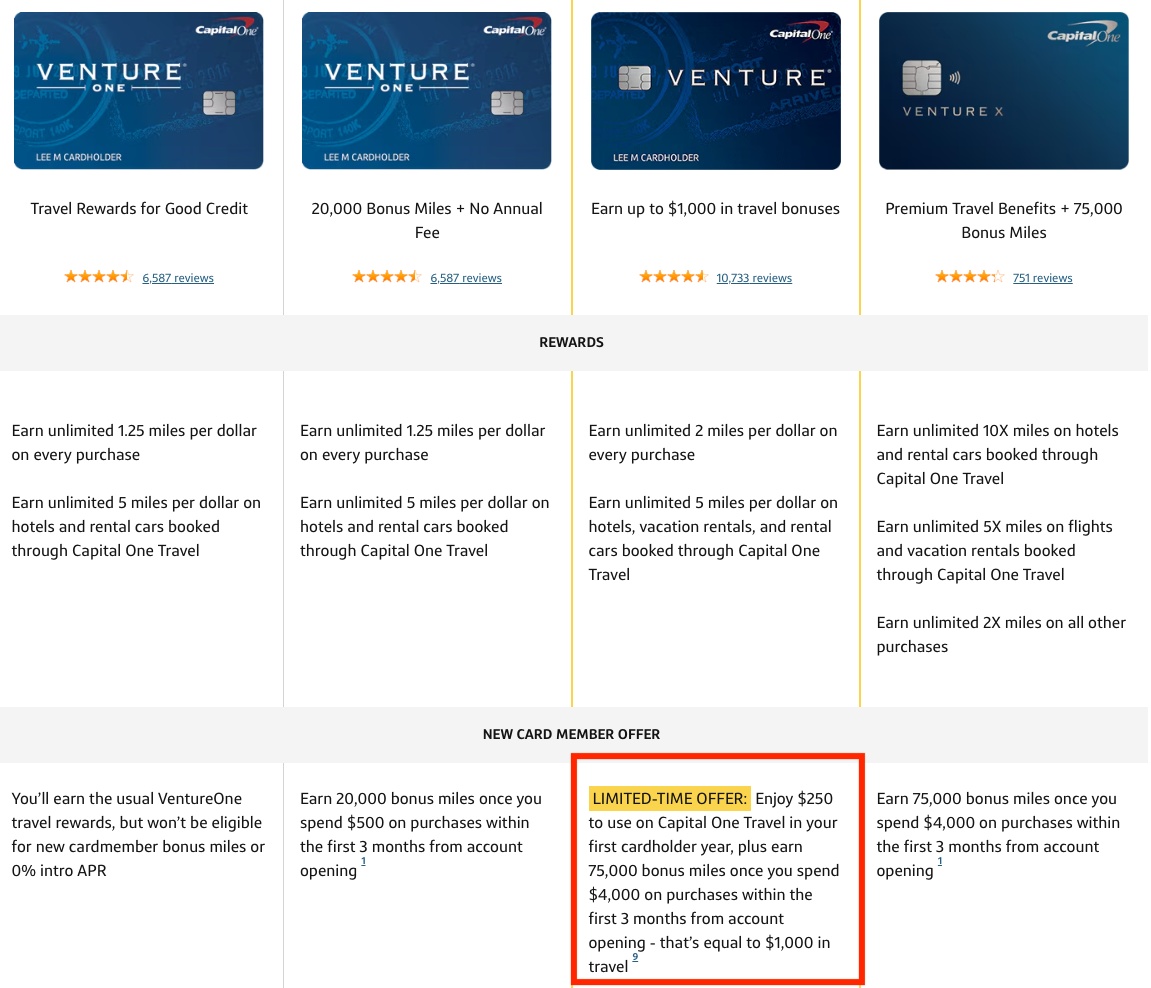

Buying / Gifting Points

You can also purchase points and miles. Buying points is a fantastic (often slept on!) way to instantly gain large sums of program-specific points (i.e., purchasing World of Hyatt or American Airline Advantage Miles) and can help save you money. If you're eyeing a flight priced higher than the cost (including taxes and fees) of buying the necessary points to redeem for that same flight, you may very well be better off purchasing the points and immediately redeeming them. The same goes for hotels. For example, last year I purchased 85,000 Marriott Bonvoy points for around ~$600, which were enough points to redeem for a night at The Mitsui Kyoto, a property asking $1300/night. A cool $700 saved off the sticker price of the room.

Conventional wisdom is to purchase points when there's a favorable disparity between the price of travel in the cash market and the points market. Arbitrage. Many folks will advise against purchasing points simply to take advantage of large sales/deep discounts due to the risk of devaluations. In reality, the decision to purchase points is hyper-specific to your travel situation. If you're a frequent traveler, you'll likely be able to put points to use and reap reasonable value in the short run.

Bottom line - It's worth looking around to see what value can be had by purchasing points. If you deplete your miles earned from your credit cards and are not in the space to chase another welcome bonus, buying points might be a compelling option. As most credit card welcome bonuses require $3K-$10k in spend, you can sometimes save time and effort if you simply buy the points needed for a redemption. Note - most travel programs limit the amount of points you can purchase each calendar year.

Redeeming Points for Travel

The fun part. There are two primary ways to redeem points:

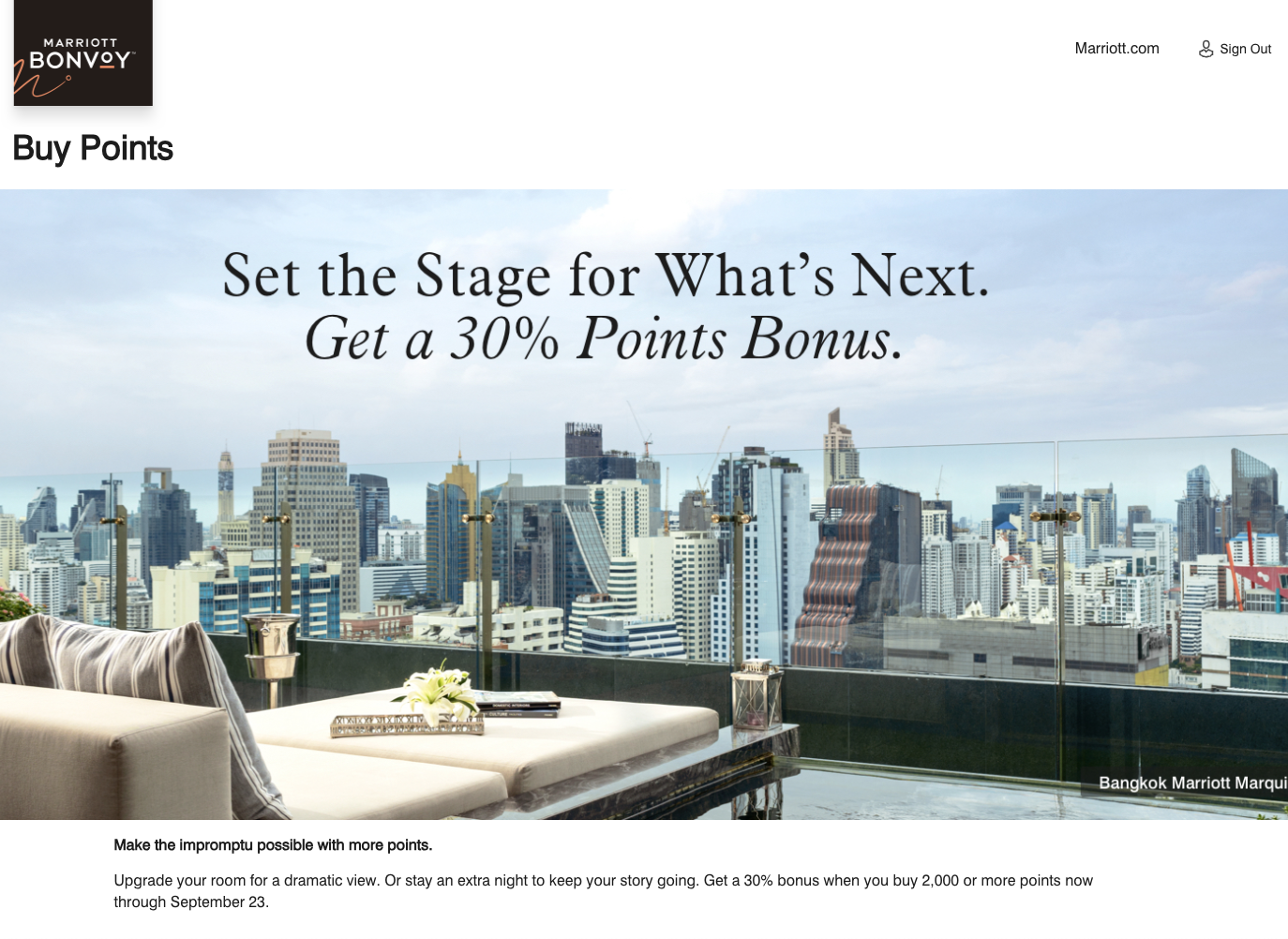

1) Booking through a bank's travel portal

2) Booking award travel directly through the site of travel provider

Redeeming Points Through Banks Travel Portals

This one is straightforward, so let's cover it first. All the financial institutions discussed above have their own travel portals that allow you to search, book, and pay for travel using bank points. For example, the Chase Travel Portal will allow you to book hotels, flights, rental cars, cruises, vacation rentals, and even activities, through its portal. You can do this through Chase's portal just like you'd search for a flight or hotel on third-party travel aggregator websites like Kayak, Expedia, or Priceline. Once you've selected your travel, you can redeem your points to cover either part or the entire cost of your reservation. Notably, bank portals are often travel provider agnostic, meaning you can use your points to cover the cost of any travel you're able to find on the portal. AMEX, CapitalOne, Citi - all the banks that allow customers to earn rewards points have a portal where you can redeem them.

Booking Award Travel Directly with Travel Providers

You can also redeem points to cover the cost of your travel - either partial or whole - through a travel provider's website. If you've amassed a number of American Airlines miles, you can use them to cover the costs of American Airlines flights and discussed below, flights on American Airline partners. You can book free nights at the Intercontinental or other IHG hotels using your IHG points on IHG.com.

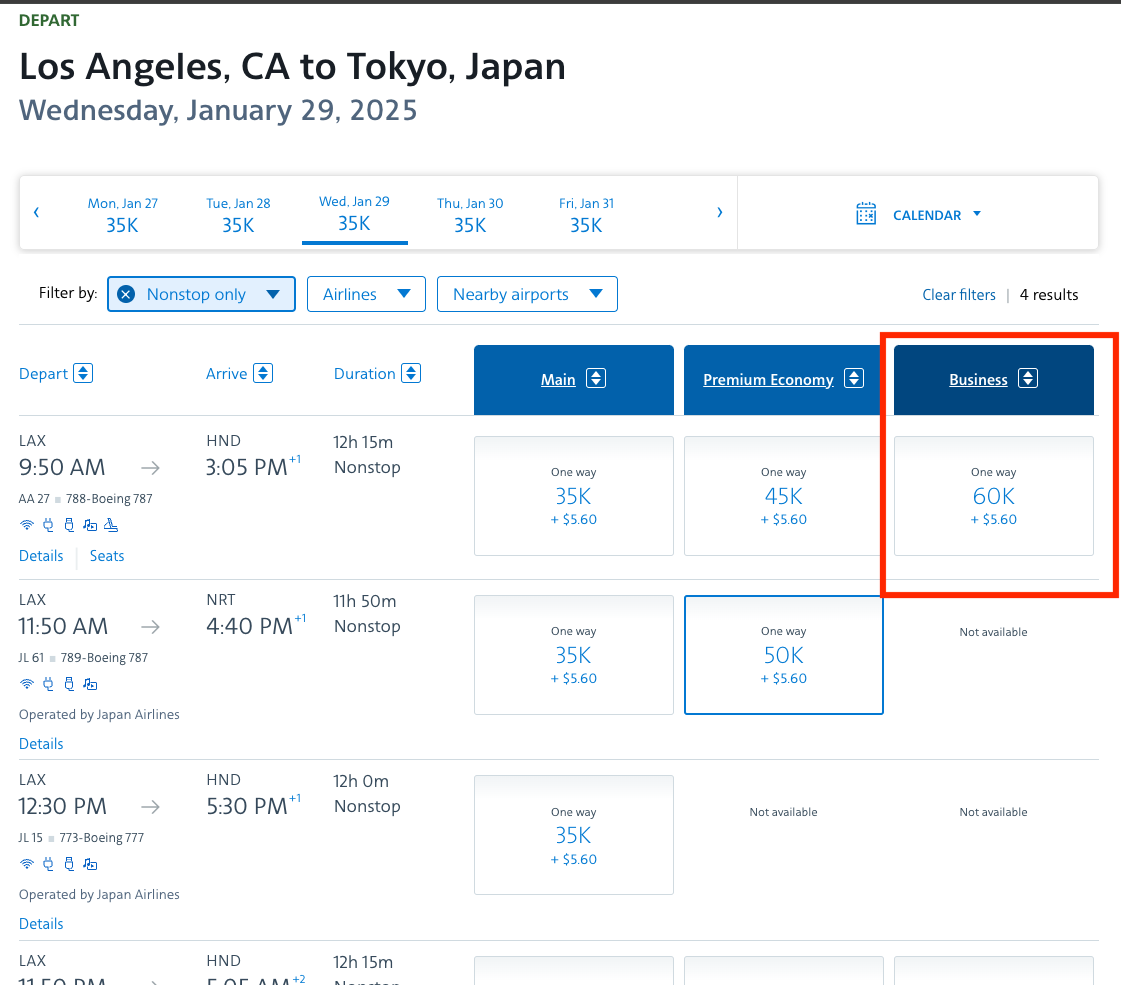

Let's discuss partner airlines. Many of the leading airlines belong to one of three international alliances - One World, SkyTeam and Star Alliance. Alliances are mega partnerships allowing for airlines to extend their route offerings, facilitating travel for customers across different regions of the world. Alliances allow airlines to build complex itineraries, cross-sell tickets on member airlines and provide their customers with alliance-wide benefits. Through alliances, (as well as individual partnerships) you can redeem loyalty-specific miles for flights operated by other alliance-member airlines. Air France/KLM miles can score you a free flight from Atlanta to London, courtesy of Virgin Atlantic. Similarly, you could use American Airlines miles to book an award flight from LAX to Tokyo on Japan Airlines.

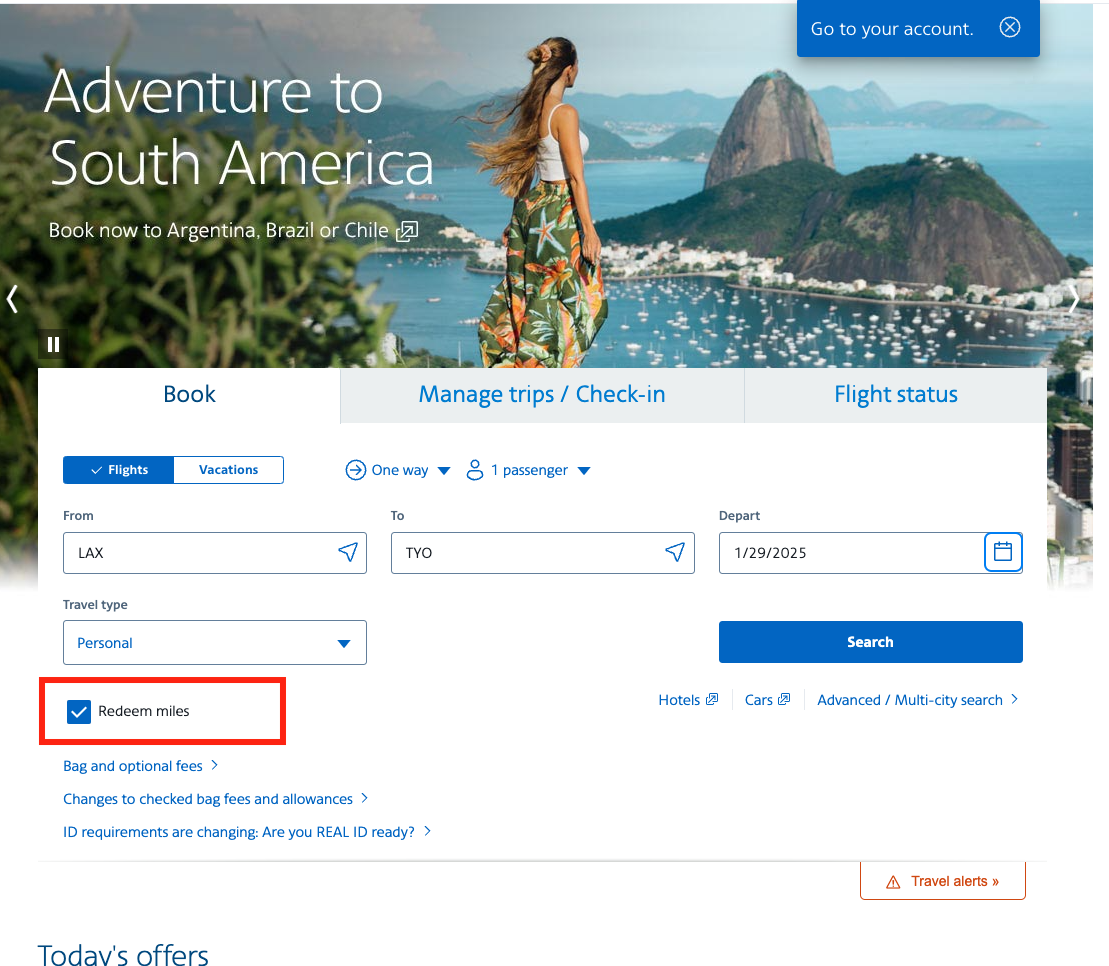

Booking Japan Air flights using American Airline AAdvantage Miles

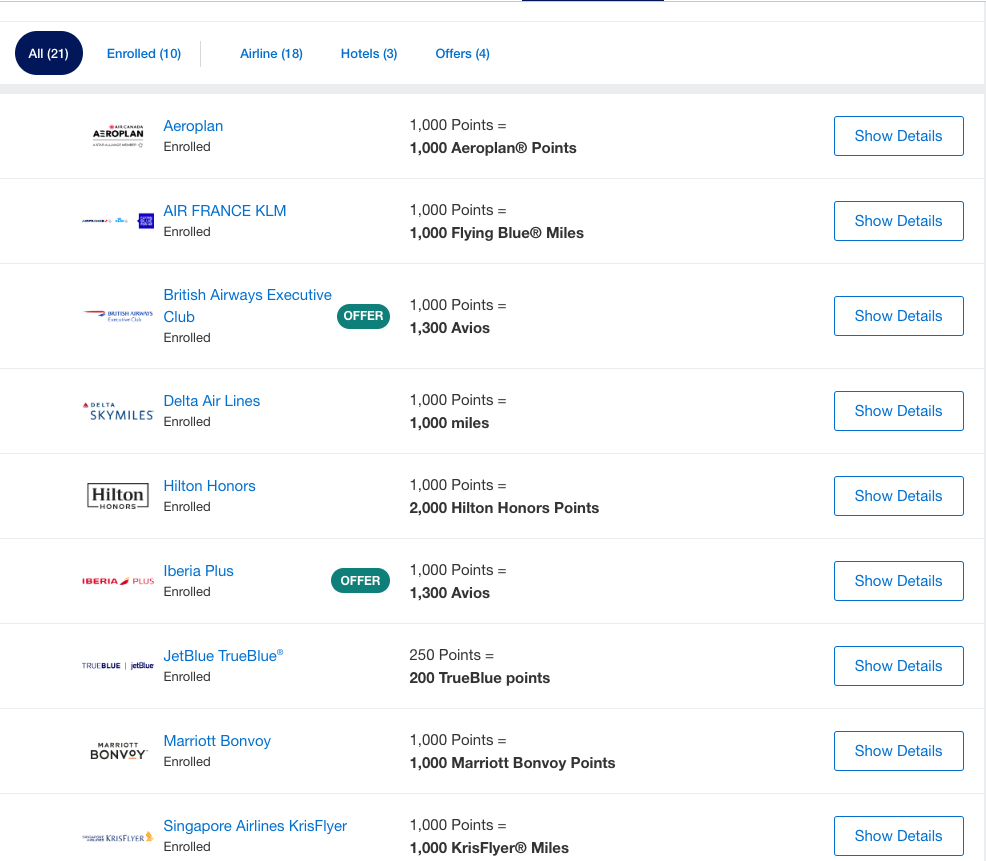

Transferring Bank Points to Travel Providers

Earlier we denoted the versatility of bank points. Well…bank points are especially coveted because they can be transferred to a host of travel providers and then used to book travel directly with that travel provider (or one of its partners). Each of the core four banks has its own list of transfer partners, but not every bank enables you to transfer points to every travel provider. Over time, you'll learn the relationship dictating which loyalty programs you can transfer points to. Suffice it to say that transferable bank points are where points and miles enthusiasts reap a lot of value.

A Tip on Finding Availability for Award Redemptions

One of the most exciting things about points and miles is the ever-evolving ecosystem. Case in point: Over the last few years, there's been so much effort put into tools that quickly award availability that it's never been easier to find redemption opportunities for flights and hotel stays. Canonically, the best resource (and traditional way) to find award availability was to search on the travel provider's (or, in the case of the airline travel provider's partner) website. While you can still do that, I recommend you check out third-party sites like Seats.aero, Points.Yeah, AwardLogic, Point.me, and Roame. By no means are these the only applications helping travelers find award space, moreso, they're some of the more user-friendly ones.

What about Loyalty Status?

We've referenced loyalty programs so much above, so touching upon the 'elite status' concept makes sense. Most modern loyalty programs are tiered and structured in a way that provides niche benefits to customers who spend more with the provider or otherwise engage with the program with the goal of aggregating more points and miles. As such, customers who stay more nights at hotels, fly more with an airline (or its partners), or spend more on co-branded credit cards can climb the tiered system, increasing their 'status' at each level. Mapped to these status are often a host of exclusive benefits specific to the travel provider or its partners. Some examples of these benefits include free breakfast, room upgrades, or enhanced check-in/out privileges with 'elite' status with a hotel loyalty program. With airline status, you might be eligible for complimentary upgrades, airport lounge access, or enhanced boarding privileges. The specifics of requirements to earn elite status differ across each travel provider's loyalty program but the key thing to know is that having status can be especially helpful in making travel more comfortable and cost-effective.