Tl;dr – JPMorgan Chase is said to become the new issuer of Apple’s credit card, taking over the relationship from Goldman Sachs.

Big news in credit card land today as the Wall Street Journal reports that Goldman Sachs may be out and JPMorgan Chase in, as the banking partner for the Apple Card. The article has all sorts of interesting tidbits, including the undercard battle between long-time rivals Visa and Mastercard, who are sparring as to who will operate the card’s rails – right now it’s Mastercard. However, Visa has allegedly offered Apple $100 million in cash to jump ship.

At first blush, this wouldn’t seem like a development worth reporting on to a largely points-and-miles-travel audience, but when you think about it, there’s a lot of potential creativity (and resources) in a Chase/Apple pair-up. First off, let’s state the obvious. Whereas Goldman Sachs has arguably floundered, or at the very minimum, simply treaded water with its consumer card offerings and adjacent products (Hello Marcus!), Chase is very much a leader in the consumer credit space.

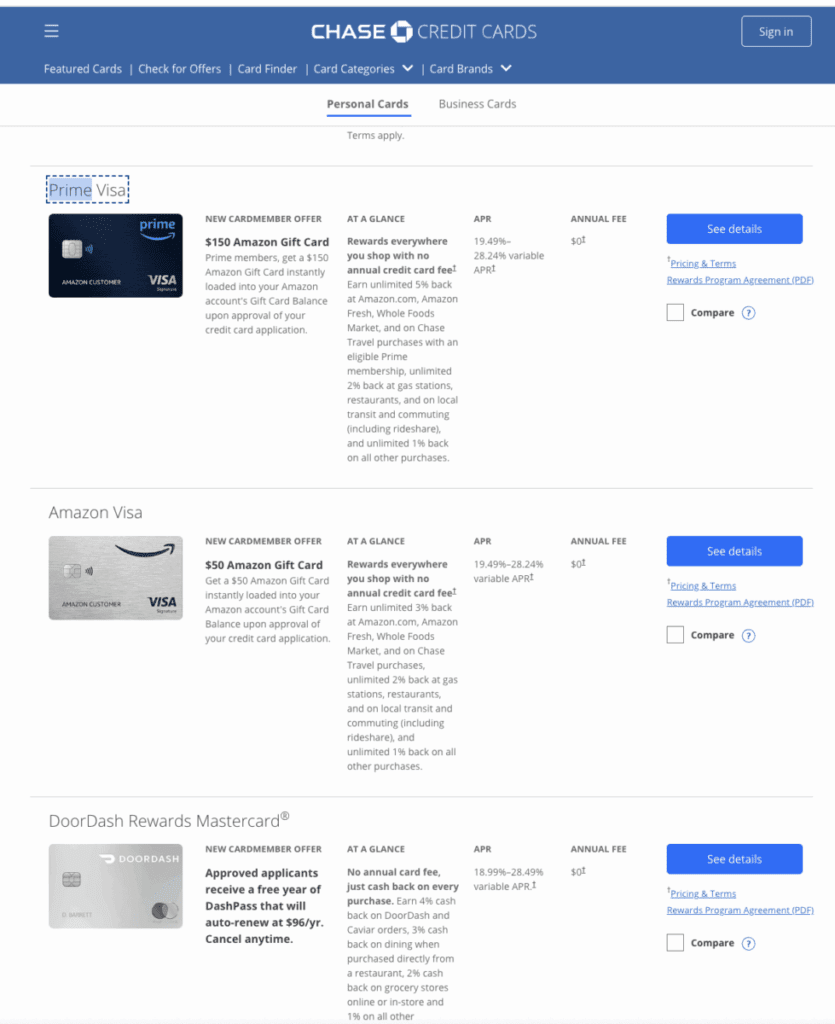

JPMorgan is already the largest credit-card issuer in the U.S. So form a sheer distribution standpoint, I’d imagine this would mean even more exposure for Apple. You go to the Apple website to apply for the Apple Card now, but I’d imagine you’d see it nestled in between these mainstays on Chase’s website as well.

Speaking of which, Chase is no stranger to partnering with some of the largest and most valuable companies in the world on credit products. Even excluding all of Chase’s card partnership with leading travel providers (various airlines, Marriott, Hyatt, IHG – btw people don’t talk enough about the fact that Chase has major skin in the game with all three of these chains, including an exclusive with Hyatt!), the bank also powers both the Amazon and Prime Visas, the DoorDash Rewards Mastercard, and the Instacart Mastercard, as well as both the Disney Visa and Disney Premier Visa Cards. (Yes, you can make an argument that the Disney card is at a minimum travel-adjacent.)

I just ran the numbers, and those four companies alone have a combined market cap of 2.78 trillion. Add in Apple? Chase’s ‘non-travel’ co-branded partners are worth almost 6 TRILLION DOLLARS.

And then there’s Apple. For many years, Apple has laid claim to the strongest ‘brand’ in the world – depending on who you ask, it might still hold this place on the mantle. Apple makes some of the most recognizable, desirable, coveted consumer products in the world and was the leading company behind one of the most significant technological developments of the last quarter century, the smartphone.

So what could this mean? Will this be the Apple Card in its current iteration, simply with a new banking partner, or might we see Apple lean into its more lifestyle-like side and get into the travel rewards game? I don’t think that’s ludicrous. Again, if there are any two companies with the resources, reach, and distribution to essentially create a whole channel to push and market such a product, it would be Chase and Apple.

For what it’s worth, while I am a bona fide Mac user, outside of that, I don’t live much of an iLife (remember that!). As such, I’ve never seen much value in getting an Apple credit card. The only co-brand cards I’ve ever pursued are those from travel partners. So even if this swap-out does come to fruition, I’ll likely look in from the sidelines at any new Apple/Chase card offering. Though I wouldn’t be surprised in the least if the two companies cooked up something more intriguing in a few years.