tl;dr – A slew of recent moves by Airbnb make it clear the platform is aggressively pursuing more traditional hotel customers and attempting to simply listing to compete with OTAs.

Recently, Airbnb has made a few moves signaling its intention to go after hotels a bit more fervently. According to Yahoo Finance, CEO Brian Chesky said as much on a recent call – “We’re going to be going significantly more aggressively into hotels.”

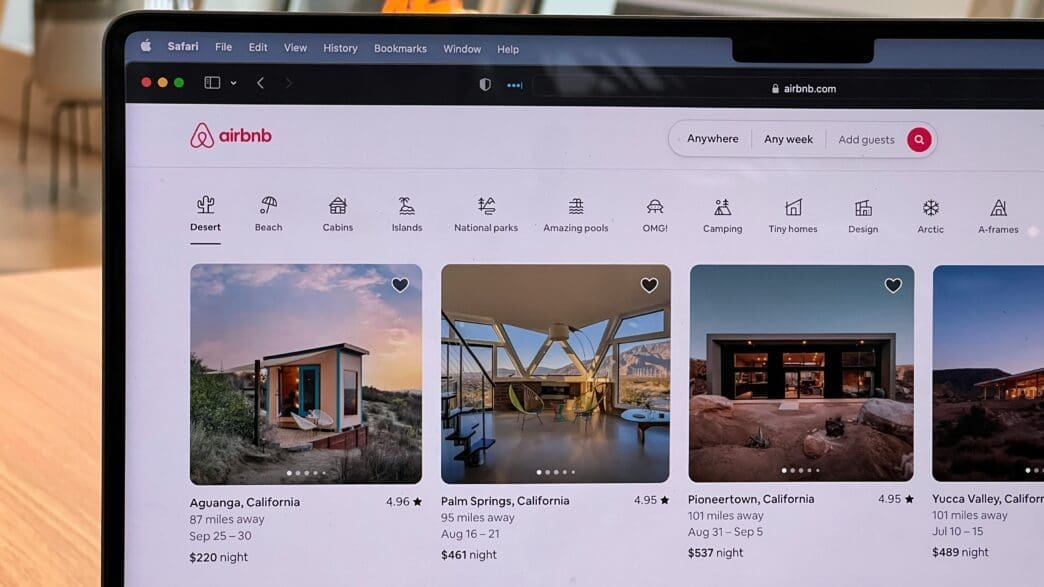

The accommodation-platform-that-wants-to-be-a-do-it-all-travel-app has long known that in competitive markets, travelers are somewhat quick to give up the search on a traditional Airbnb listing if they can’t find what they want quickly enough. At which point, they are likely to turn to a hotel. Seeing as how home inventory is hard to manipulate, Airbnb is instead attempting to retain those users by listing independent hotels alongside traditional Airbnb listings on its platform.

Chesky acknowledged that from its pre-pandemic acquisition of HotelTonight, there were already some of the rails in place to make these moves. While the pandemic temporarily derailed those plans following the 2019 acquisition, Airbnb now plans to launch a hotel interface. Additionally, earlier this year, and somewhat quietly, I might add, Airbnb launched a quasi-rewards offering of sorts where guests booking rooms through HotelTonight could earn Airbnb credit with every hotel stay.

Other initiatives aimed at wooing hotel customers are the relaunch of its Experiences platform and experimenting with ‘hotel à la carte’ offerings.

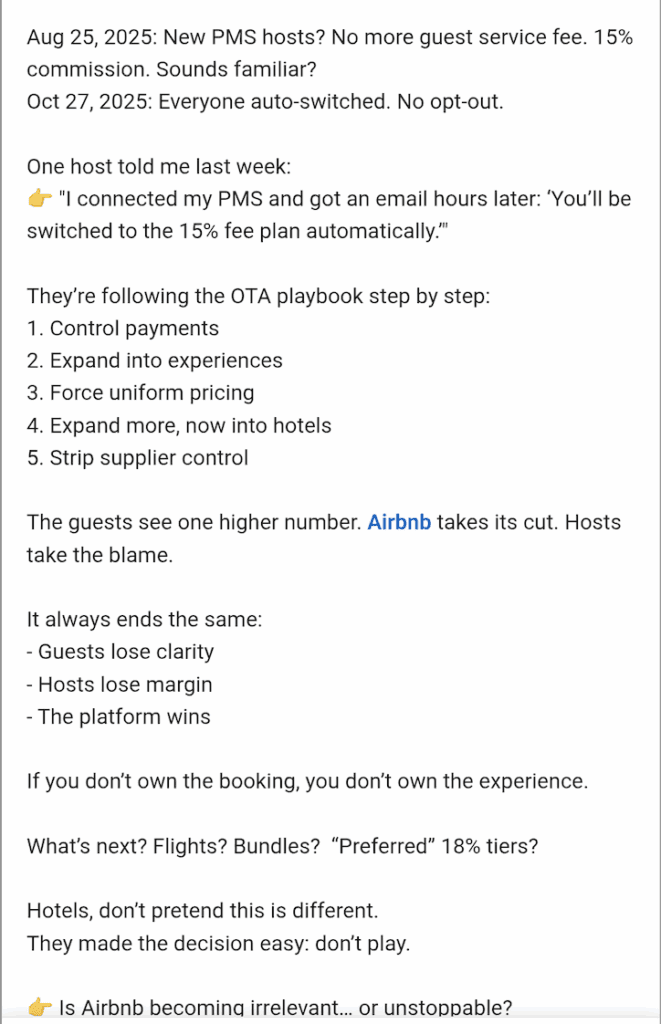

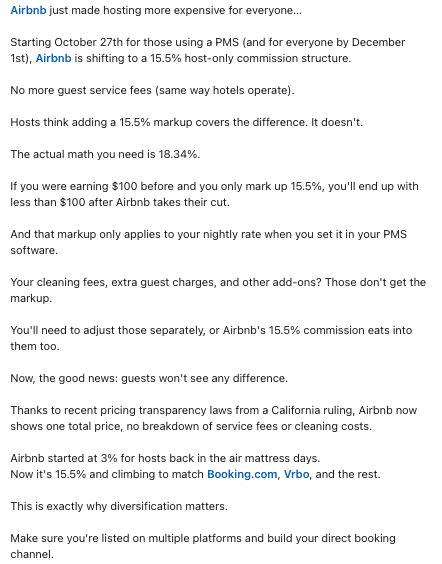

The company also made strategic changes to its pricing model to make it more competitive with traditional OTAs (Booking.com and Expedia), chiefly deploying a PMS model, moving to a host-only fee, and removing guest service fees.

There’s been a good amount of chunder about this on the internet, especially LinkedIn, where it’s not uncommon to find a dramatic-unnecessarily-multi-lined-space-opinions on the subject:

It’ll be interesting to see what comes of this, but I have questions right now. Candidly, I’m not the biggest user of traditional Airbnbs myself – I’ll almost always opt for a hotel – so there’s a product positioning/branding issue for me to start. More importantly, I’m a bit unsure what incentives I’ll have to book a hotel room through Airbnb as opposed to 1) directly with the hotel to maximize earnings/status 2) through a partnered hotel platform where I can receive other rewards (AAdvantage Hotels, Rocketmiles), or 3) through an established OTA that if it comes down to it might be able to offer a more competitive price.

We shall see!