Tl;dr – Pop in for lunch (or dinner) at a Hilton property near you to use some of that $200 credit.

Recently, Mrs. Blackbeard and I decided to put the $200 Hilton Benefit from her American Express Business Platinum Card to the test by using the card to pay for a meal at a Hilton property where we were not staying. If you’re unfamiliar with this card benefit, cardholders of American Express’s Hilton Honors American Express Surpass Card, Hilton Honors American Express Business Card, and American Express Business Platinum Card receive an annual $200 statement credit for purchases at Hilton properties.

This is broken down into $50 statement credits per quarter. When I was an Amex Business Platinum cardholder (I cancelled my card last year), I used the $200 Hilton credit for a stay, or more accurately, for a $50 credit on one stay, during a given quarter of the year. While this $50 credit is something, it’s more of a pain than it’s worth. Accordingly, I’m a staunch believer that ‘lunch or dinner at Hilton’ is the best way to use these credits. Here’s a look at our recent experience.

Note: If you’re a American Express Business Platinum cardholder, you’ll want to make sure you active the benefit and enroll in Hilton for Business before attempting to use the credit.

The Pain with Semi-Annual or Quarterly Credits as a Card Benefit

I understand the weariness of cardholders who bemoan how seemingly every card benefit has become a voucher or coupon, requiring them to keep abreast of its redemption rules constantly. I wish there were less red tape surrounding the use of the ‘credit’ benefits attached to many premium credit cards. In an ideal setup, credit card companies would eliminate the quarterly or semi-annual breakups of these credits, allowing cardholders to exhaust the value of the credit in one transaction, which more closely aligns with most people’s travel patterns. I understand the financial reasons behind why credit card companies operate in this manner, but sigh…I guy can still dream.

Dinner at the Hilton on Amex?

The other day (just before the end of Q2), while traveling in Costa Rica, we decided to order some food from a Hilton we’d passed earlier in the day for a takeout dinner. Although I’d read various anecdotes about Hilton Amex or Amex Business Platinum cardholders successfully triggering the $50 quarterly credit by making a dining purchase at a Hilton property where they were not staying, I wanted to test it out myself.

Earlier in the day, I passed by a Hilton Garden Inn that had unexpectedly received promising reviews for the quality of its food.

We decided to roll over there to grab some dinner for takeout. After rolling into the hotel’s lobby and heading over to the restaurant, I placed a to-go order with the server.

Once the food was ready, Mrs. Blackbeard dropped her American Express Business Platinum card into the slip as we waited for the server to process her payment. Once approved, we signed the slip and departed with our food. To my luck it was ‘burger month’ (what a time to be alive).

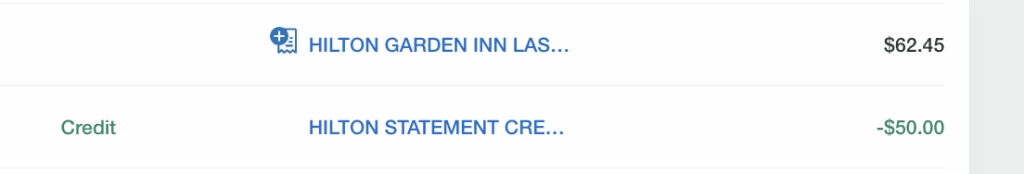

We went classic and straightforward – burgers and fries, along with a brownie à la mode. The total (after tax, tip, and a mandatory gratuity) was $62.45.

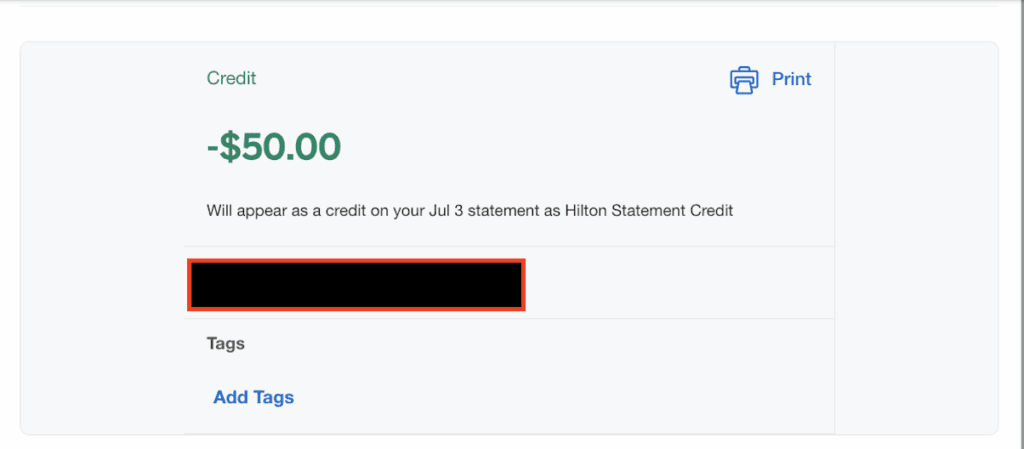

From my experience, Amex is one of the better banks at posting statement credits quickly, once a transaction successfully triggers them. And that was just the case here. A few days after our meal, we checked Mrs. Blackbeard’s online account and noticed that Amex had already added a $50 credit, offsetting a hefty portion of our meal.

The whole ordeal was painless, and going forward, there’s a much greater chance of us successfully exhausting these quarterly credits this way, as opposed to staying at a Hilton hotel each quarter.

Yes, $50 is $50, whether it’s deducted from your folio at the end of your stay or covers most of a simple meal, but I derive a lot more satisfaction from using the credit this way. Perhaps it’s because there’s less investment (I don’t need to be on a trip or plan a staycation) – I simply need to be hungry.

Another interesting note about the posting of the most interesting is that the charge posted under the ‘Lodging’ category code.

This has me curious as to whether other purchases made in a Hilton property (excluding room rates and stays) would also qualify, such as a gift shop purchase. I’m not a trinket shopper, but if the credit can be triggered from a gift shop purchase (I haven’t tried), then it’s even more flexible.

Bottom line, if you’re struggling to get value out of these credits, consider treating yourself to a meal!